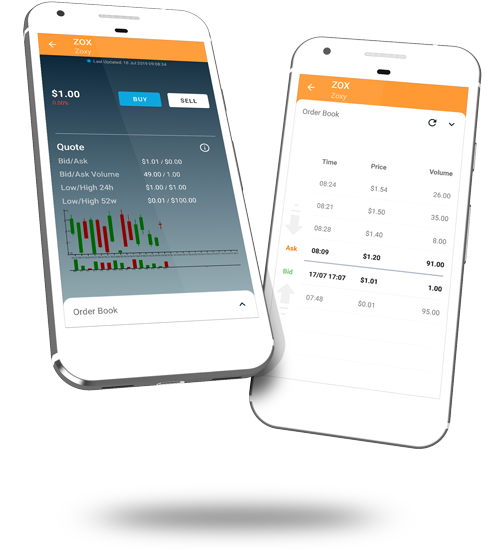

Secure, instant, & open trading directly from your smartphone.

Trading-pairs are quoted, traded and immediately settled exclusively against the exchanges’ deposits of fiat currency.

Offers to buy and sell shares are displayed in real-time, unlike a traditional order book which only displays volumes provided by commercial market makers.

Traders alone hold their cryptographic key and all trades are digitally signed, adding increased investor protection from dangerous hacks.

Designed to look and feel like a traditional public marketplace with trades conducted on a best bid and offer basis, with integrated cash custody services.

All transactions are cryptographically secure with timestamped transaction records stored on regulatory compliant storage media.

Our smartphone trading app technology backed by our real-time matching-engine was designed for the everyday investor with secure, clear and intuitive functionality

Open Order Book unlocks secondary market liquidity for issuers and their investors with a global network of accessible trading venues.

We build our technology to be as compliant as possible without sacrificing critical investor protections or user-friendliness.

Open Order Book integrates with Horizon’s in-house suite of securitization, KYC/AML investor onboarding, and transfer agent custody solutions for seamless issuance through to secondary trading.